$262 billion worth of claims get denied on an annual basis according to HFMA. If you ran the math and divided that number by the total number of healthcare providers in the U.S., it would amount to around $5 million worth of denials per.

That’s an insane statistic.

If the average dollar amount of denials costs providers that much, regardless of the size of their practice, how are they supposed to keep their doors open?

I must confess, though. The reality is that the denial landscape is different for every healthcare organization. Although it sounds scary, taking the total yearly cost of denials and dispersing it across the entire industry isn’t accurate.

In other words, your organization’s average denial rate is going to be different from the mental health facility up the street.

Regardless as to how well or grim the denial landscape at your organization looks, though, I have a more helpful statistic for you to know. More than 85% of denials are potentially avoidable and one-third of them are absolutely avoidable.

Those two data points are the reason why I made the frank remark that it doesn’t really matter how well or poorly your organization handles claims that come back from insurance providers with a denied status, there’s always room for improvement.

Of course, the next piece of that puzzle is determining the most common types of denials your organization sees the most.

It’s a good thing insurance providers include a reason code in the electronic remittance advice that they send back to your clearinghouse provider.

Taking a look at the reason codes you receive for your denials will give you a better idea as to what processes you need to change in the name of boosting your revenue.

After being a clearinghouse provider for over 20 years, though, we’ve started to notice some trends regarding the most common types of denials.

Out of all of them, though, there’s one in particular that stands out from the crowd more than the others because it happens a lot and it’s super easy to avoid…timely filing.

If you have a pile of timely filing denials, there’s still hope to receive payment for them…it’s just a matter of knowing what to do and how to execute the steps properly. That’s exactly why I’m writing this blog post, here are 3 effective appeal letter for timely filing samples.

Table of Contents

Understand Timely Filing Denials

In order to have any success appealing your timely filing denials, you need to understand what happened to your claim.

I want to preface this by saying you shouldn’t take denials seriously. Although it might sometimes feel like insurance organizations just don’t like claims that come from your organization, that’s not the case. They deal with thousands if not millions of submissions from providers all across the country on a daily basis, so they have no choice but to put up guardrails.

If insurance payers didn’t place requirements on the claims they recieve, the reimbursement process would take even longer than it already does.

All of this brings me to timely filing denials. You see, this type of denial is nothing more than an indication that you failed to meet a particular requirement placed on the payer.

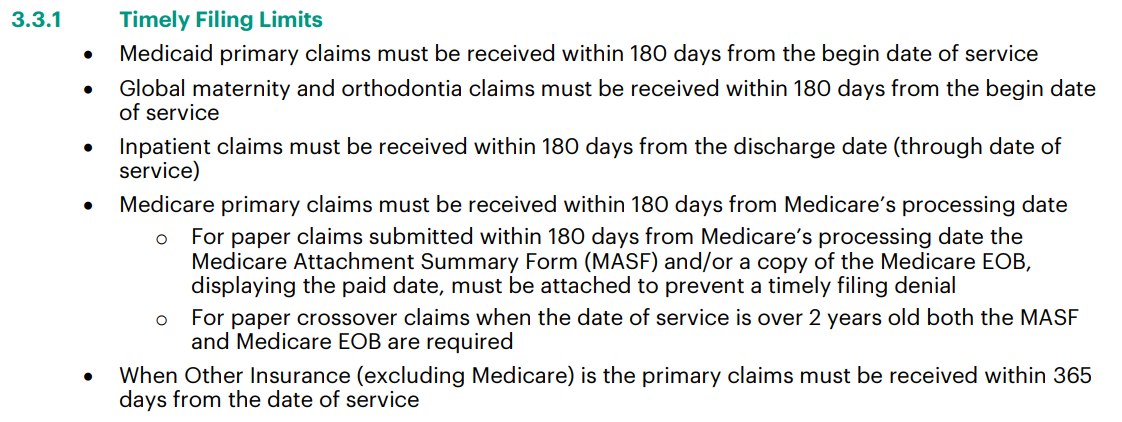

Almost every insurance organization places a timely filing limit on submitted claims. This requirement is nothing more than a deadline to submit. It’s usually detailed within an insurance organization’s provider manual.

via Vermont Medicaid

The image above comes from Vermont Medicaid’s provider manual. In this example, the timely filing limit for primary, maternity and orthodontia claims is 180 from the begin date of service. It goes on to detail some minutiae scenarios that includes paper claims and inpatient claims but the deadline doesn’t change.

So, if a patient had an appointment at your facility and they used Vermont Medicaid as their insurance, you would have half of a year to submit that claim to Vermont Medicaid.

Simple enough, right?

Well, as you likely know, submitting a claim to a payer isn’t as easy as it sounds. There are a lot of checks and balances both within your organization and with your clearinghouse to ensure accuracy.

While all of those processes happen, your organization needs to continue to see more patients. Those patients likely all have different insurance providers…not just Vermont Medicaid.

You can see how things can get out of hand. Of course, in this example the 180 limit passes by faster than you anticipated, you submit the claim and receive a denial.

That’s it. That’s how timely filing denials happen in a nutshell. If you don’t submit a claim within the deadline provided by an insurance organization, it’s going to get denied and you’re going to have to write an appeal letter.

Timely Filing Appeals

I need to be frank, timely filing denials aren’t easy to appeal.

Insurance organizations have their requirements and stick to them. If they didn’t budge a little bit, though, you wouldn’t be here…reading this.

The reality is that you can appeal timely filing denials. Receiving them doesn’t mean your only option is to write them off as a loss in your revenue.

You see, the best option to conquer timely filing denials is to stop them in your “front-end” processes…before you submit them.

But, there are instances that exist where you can appeal a timely filing denial… it just depends on the scenario.

Sample 1: Reconsideration Request

As I alluded to in the section before this one, there are situations where you can appeal a timely filing denial.

Insurance organizations allow for providers to submit reconsideration requests on denied claims.

Of course, reconsideration requests aren’t as easy as they sound. Like with submitting claims, submitting a reconsideration request also means jumping through a lot of hoops.

Frankly, reconsideration requests are arguably more difficult than submitting claims.

Remember the provider manuals from earlier? Insurance companies detail their reconsideration request criteria within that massive document as well…usually right under timely filing requirements.

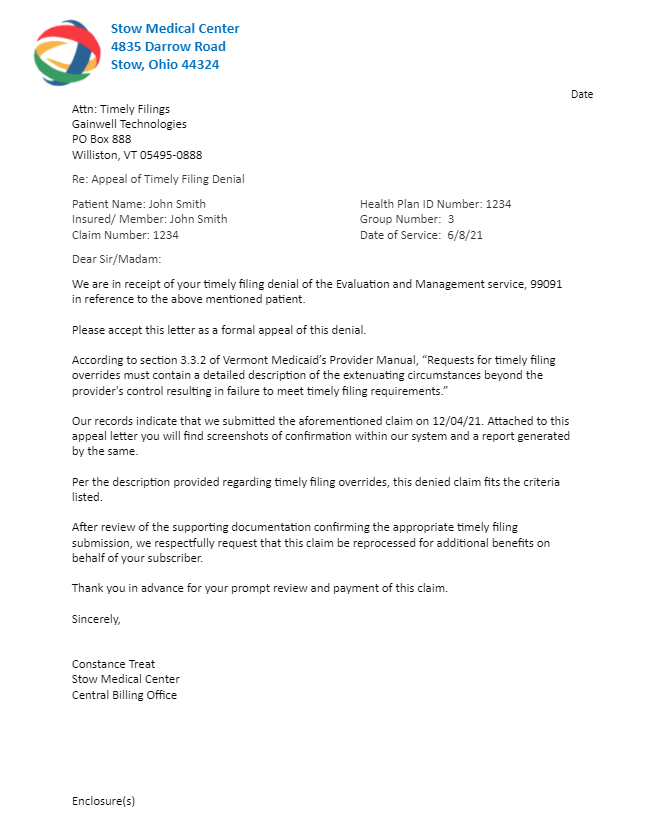

via Vermont Medicaid

Ironically, timely filing reconsideration requests come with a deadline as well. The image above again comes from Vermont Medicaid’s provider manual.

After this first paragraph, Vermont Medicaid’s timely filing reconsideration request section goes on to describe what does and doesn’t qualify. The section is an entire page long.

The most important aspect to keep in mind when sending your appeal letter for a timely filing denial is documentation. You need to make sure that you provide the letter, the denial in question and documentation as to why it qualifies for reconsideration.

It’s also a good idea to cite the reconsideration request requirements within the insurance organization’s provider manual within your letter.

Sample 2: Reconsideration Form

Similarly to how insurance organizations receive truckloads of claims every day, they also get hit with a lot of appeal letters. Of course, the appeal letters they receive are only a fraction of the amount of denials they send out.

The truth is that some providers don’t even bother with denials and just write them off as a loss.

Even though the amount of appeal letters received isn’t as high compared to claims, insurance organizations will sometimes mandate reconsideration forms.

This next appeal letter for timely filing sample is exactly that, a templated form provided by an insurance organization for reconsideration.

Of course, it comes from Vermont Medicaid (talk about staying consistent).

This form has to be filled out for Vermont Medicaid to even consider appealing a timely filing denial.

Since every payer is different, you’ll need to find and download the reconsideration forms from those who require it. Usually, these forms are found in the payer portal online or within its provider manual.

Sample 3: Lost Claim

Let’s say that you went through the entire process of submitting a claim, ensured its accuracy, scrubbed it with the help from your clearinghouse and sent it before the insurance organization’s deadline.

After all of that, though, a few days go by and you still receive a timely filing denial for that claim.

How could this scenario happen?

Well, as much as they would like to think they are…insurance companies aren’t perfect.

Much like you, once they receive a claim, they have a series of checks and balances that they go through. They need to ensure that what you submitted is acceptable by their standards.

Yet, those processes don’t protect insurance organizations from misplacing claims.

You see, it all goes back to the point I made earlier while defining timely filing denials. Thousands of healthcare facilities also submit their patient’s claims to the same insurance organizations you deal with every day.

Since insurance organizations get bombarded with claims, some are bound to fall through the cracks.

When you inevitably run into this scenario, you need to be very particular about the wording you include in your appeal letter.

The biggest takeaway from this example is that you need proof.

If an insurance company lost your claim, it doesn’t know that. In other words, its team never received your claim since they don’t have it in their eyes.

That means that the burden of proof falls on you. You need to prove that you submitted the denied claim AND that it was within the insurance organization’s timely filing limit. That means that what you write has to point to screenshots and/or attachments you also include in your re-submission.

Conclusion

Dealing with insurance provider requirements for claim submission is a headache. There’s a reason why large healthcare facilities have entire medical billing teams devoted to submitting claims and appealing denials, it’s not easy.

To make matters worse, there aren’t any guarantees when submitting claims and you can’t appeal certain types of denials after they’ve reached that status.

Some experts place timely filing denials within that category, but that’s simply not the case. Although this type of denial is better served as an alert that you need to button up on your front-end processes, you can appeal it in certain circumstances.

Those circumstances happen more often than insurance providers want you to know.

Receiving money from a timely filing denial is a matter of sending the right type of appeal letter.