Recovering revenue from healthcare insurance providers is one of the most important aspects of running a modern-day practice.

In fact, that last sentence alone fuels a $49.6 billion industry today that’s expected to grow to $84.1 billion by 2028. Of course, what I’m referring to is the revenue cycle industry.

If you’ve ever tried to work through the revenue cycle for your business alone, you likely know how convoluted the process is.

After all, there’s a reason why most healthcare organizations seek to outsource their revenue cycle management entirely. To pile on, studies estimate that inefficient revenue cycle management processes cost the entire healthcare industry $16.3 billion in 2020.

In our 20+ years of providing services that help healthcare organizations streamline and collect on this intimidating process, we’ve noticed a pattern. The loss in revenue associated with this process is less about its clunkiness and more about a lack of understanding.

In order to begin understanding the revenue cycle, a good starting point is taking a deep dive into the healthcare claims themselves.

In the modern revenue cycle process, there are two main types of claims; 835s and 837s. To put it simply, these file types are essentially the bill and the receipt. But, there is more minutiae involved. Let’s take a deeper look at these types of healthcare claims.

Table of Contents

Defining Healthcare Claims and Remittances

If you held a conversation with a claims clearinghouse or a medical biller about the revenue cycle. You would hear the word “remittance” within the first few sentences. I’m not joking, I did this myself internally at Etactics and it actually happened.

So, what does remittance mean?

If you were to Google the definition, it would come back explaining that it’s a “sum of money sent, especially by mail, in payment for goods or services or as a gift.”

In the scope of the revenue cycle, the definition changes a little bit. In most cases, it's the term used to describe the process that insurance companies go through to send money back to a person or organization electronically.

It doesn’t have to be electronic. There are still some insurance companies out there that still handle and deal with paper claims. But, the majority of payers rely on electronic claim submission.

As you can imagine, remittance is an important aspect of the revenue cycle. I mean, it practically fuels the whole thing. Due to its importance, one mistake could lead to some serious issues that take weeks to untangle.

Potential Remittance Issues

So, what kind of issues may arise when it comes to remittance within the scope of the revenue cycle?

For starters, we need to discuss electronic funds transfer (EFT).

As we know, healthcare claims start at the point of service with a patient. Prior to providing treatment to a patient, healthcare organizations usually request the patient’s insurance information. Upon receiving that information, it becomes the healthcare organization’s responsibility to seek compensation from the insurer based on the patient’s contract.

The average doctor sees 2,500 patients per year. That’s roughly 7 patients every day. Imagine if all of those patients had different insurance? Even if just 20% of them had unique healthcare insurance, that would still be 500 patients.

In other words, a healthcare organization would need to familiarize itself with the different claim submission requirements for 500 different insurance organizations. Yikes.

That scenario we just briefly walked through is one of the main reasons why healthcare organizations seek the services of clearinghouses. A clearinghouse acts as the middleman between healthcare organizations and insurance organizations. They’re already familiar with the claim submission requirements that insurance companies set in stone. Thus, allowing healthcare organizations to focus on running their practice and treating their patients.

Anyway, when a healthcare organization teams up with a clearinghouse. It will send a claim in its electronic 837 format to the clearinghouse. This 837 claim will contain information about…

Diagnoses

Procedures

Services performed

Dates

Locations

Charges

Provider information

Prior to sending a claim to an insurance provider, a clearinghouse will run a series of checks on the claim to try to find errors. Clearinghouses refer to this process as claim scrubbing. If it doesn’t find any errors, it will move forward through the process and send the 837 claim to the insurance provider.

In a perfect world, an 837 claim with no errors received by a clearinghouse that an insurance organization is already familiar with would lead to instant approval and revenue returns. But that’s wishful thinking.

The reality is that the process of evaluating submitted claims, calculating remittance and sending it back to the healthcare provider could take weeks or months.

To make matters worse, insurance providers don’t really tell you why they send you money. It just appears as a deposit into one of the healthcare organization’s bank accounts. But wait, there’s more.

The funds received from a payer are almost never the same as what was originally included on the 837 claim submission. 837 submissions are usually inaccurate due to adjustments to pricing made by both the healthcare organization and the insurance organization.

The deposit made by the insurance provider ALSO usually ends up being a large sum that could include multiple 837 claim submissions made to that insurance in one. Although that may help speed up your revenue collection process, it’s a nightmare from an accounting perspective.

Imagine receiving multiple payments bundled into one…but each of those combined payments isn’t the same as what was originally asked for. To have accurate books, you need to deconstruct these bundled payments and figure out what sum of money reflects original submissions even though there was an adjustment. Not fun.

I haven’t even mentioned the other common issue that occurs with the 837 and 835 claim submission process. It’s not uncommon for healthcare organizations to have multiple bank accounts. Sometimes the money associated with an 837 remittance doesn’t always go to the preferred bank account…which only complicates things further.

What is an 837 file in healthcare?

Alright, I might’ve gotten a little ahead of myself in working through some of the common problems associated with the claim submission process. Let’s take a step back.

An 837 is an electronic file that contains data. It’s used by healthcare organizations to communicate healthcare claims. That’s pretty generic, right? I mean, with a definition that generalized, couldn’t a CSV document exist as an 837 file?

The biggest difference between an 837 and other types of electronic files is that it’s HIPAA compliant. As I mentioned in the introduction to this blog post, paper claims were a thing (arguably still are depending on the insurance organization you’re working with). If you were a healthcare organization that planned on operating via paper claims only. You would use a CMS-1500 claim.

Why are 837s Important?

I mentioned this a little earlier, but 837 claims are so important because they ensure timely and accurate remittance. In other words, practically every healthcare organization relies on them to receive revenue.

837 Components

As you can infer from the image of the CMS-1500 form in the section earlier, there is a ton of information that goes into a claim. It’s no different on the 837 side, it’s just in an electronic format.

Of course, 837s contain data points related to the patient visit. To put it simply, this information usually includes demographics, conditions, services provided and treatment costs.

Although those data points seem straightforward, if you’ve never seen an 837 before…you’re in for a real treat. There’s a method to reading them.

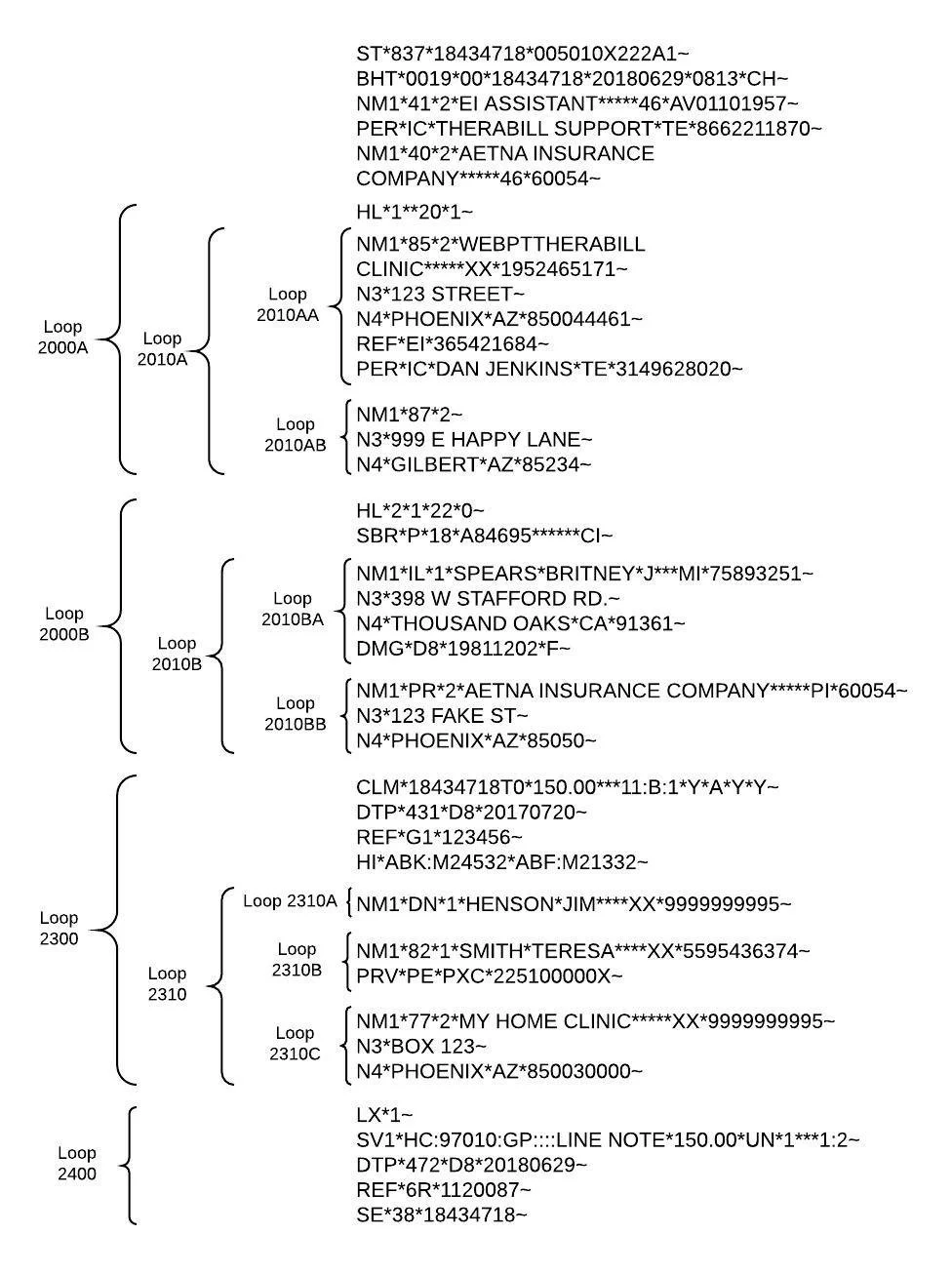

837 claims include loops, segments, elements and sub-elements.

via Therabill

The image above is a great example of an 837 claim that’s formatted out in a readable way. The strings of code on the right-hand side are the claim information. The brackets on the left help visualize loops.

There are 5 main sections of loops…

2000A = Billing Provider

2000B = Subscriber

2000C = Client (Only present if different from Subscriber)

2300 = Claim Information

2400 = Service Line Information

If you didn’t have the handle image above in hand. You can identify different loops within a claim by the sections that start with “HL”. The “HL” signifier helps signify large loop sections. Within loops, there are segments. You can identify segments by looking for…

NM1- Name

CLM- Claim

PRV- Provider

SBR- Subscriber

N3- Street Address

N4- City, State, and Zip code

SV1- Service

DMG- Demographic

DTP- Date

REF- Reference

Elements are the specific data points within each line of a claim. One line could contain several elements, separated by an asterisk or colon. Element codes include…

85- Bill Provider

Y4- Claim Casualty Number

HC- Standard CPT Code

41- Claim Creator (Hardcoded to EI Assistant)

ABK- Principal Diagnosis

IC- Information Contact

XX- NPI

EI- EIN or Tax ID

472- Date of Service

82- Rendering Provider

77- Service Location

DN- Referring Provider

40- Claim Receiver

ABF- Diagnosis

SY- Social Security Number

After knowing all of that now, can you point out where the payment information is in the example claim above?

Loop 2400 is the one to look out for as it provides the dollar amount associated with the specific claim.

The highlighted element in the screenshotted section above represents the dollar amount associated with the claim.

Obviously, if you have a clearinghouse provider you don’t need to understand the 837 claim language like the back of your hand. You can go ahead and breathe a sigh of relief.

However, knowing how to read an 837 claim goes a long way in helping you ensure accurate and timely reimbursement.

That lost point is especially true when I tell you that 837 files oftentimes contain more than one claim. Remember the scenario I explained in the “Potential Remittance Issues” section? The one where you have to backtrack through and figure out what an insurance organization paid you for? Understanding how to read a claim helps figure out this common issue faster.

Benefits of 837 Claims

Where did 837 files come from?

Healthcare as a whole started heading towards 837 and 837 claims with the inception of the Health Insurance Portability and Accountability Act (HIPAA) in 1999.

Just one year after the inception of HIPAA, Congress started mentioning the need for electronic data interchange (EDI) in healthcare.

By 2003, 837 and 835 claim formats became the standardized and encrypted method to transmit healthcare claims and the sensitive information contained within them.

But, other than the fact that they’re the required format for electronic claims, are there any benefits to 837s?

Of course, let’s go through them.

Precise Information Exchange: You can only imagine what kind of mistakes occurred in the paper claim submission process with paper CMS-1500 forms. Paper claims naturally open up the door to more mistakes through data entry and even misinterpreted handwriting. 837s have a standardized digital format which leads to more precision and accuracy. Naturally, that also means fewer claim rejections and denials.

Mistake Detection: The standardized format of 837s also makes it easier to detect mistakes within the claim prior to submission to insurance. This is usually accomplished through your clearinghouse. However, it leads to fewer processing delays and a higher rate of remittance success.

Improved Data Quality: The increase in data quality associated with the formalized format of 837s leads to improved data quality. Gone are the days of billing teams spending hours deciphering information on paper claims.

Security: Since the government mandated the use of 837s in the healthcare space to align with HIPAA, they practically guarantee security. This leads to less leakage of sensitive patient information.

What is an 835 file in healthcare?

An 835 claim file is the format that insurance organizations send back to healthcare providers. To put it simply…

Providers send 837s to insurance organizations

Insurance organizations process the claim

Insurance organizations send back an 835

In other words, an 837 is a bill and an 835 is a receipt.

Sometimes 835 claims are also called Electronic Remittance Advice (ERA). Similar to 837s, they provide information about the rendered healthcare services. This includes data points such as…

The medical treatment charged

Reductions and/or changes from the 837

Deductibles

Co-pay amounts

Healthcare claim splitting

Co-insurers

Bundling

The Importance of The Right Clearinghouse

I’ve hinted at this section throughout this entire blog post. But, the reality is that one of the most important decisions that a healthcare organization can make is choosing the right clearinghouse partner.

Clearinghouses exist as the middleman between the healthcare organization and the insurance organizations. They establish thousands of connections with insurance organizations so that the healthcare organizations they work with don’t have to worry about managing those logistics.

But, what separates average clearinghouses from others isn’t connections made to insurances. That’s a standard. Instead, it’s the quality of service and understanding of common issues that arise during the submission and remittance processes.

In other words, if you choose the right clearinghouse, you won’t have to worry about trying to decipher 835 deposits. The clearinghouse will be able to decipher those transactions and data for you, providing you with remittance reason codes.

Bonus points if the clearinghouse partner can also help you manage, clean and resubmit claim denials.

Conclusion

In short, 837s and 835s coexist to be able to communicate service and financial data in the healthcare space. They were also mandated data file formats that came as the result of HIPAA’s requirements.

Although they’ve helped streamline processes and lessen mistakes in comparison to paper claims, they aren’t perfect.

There are still shortcomings that happen in association with them, which could lead to serious confusion and revenue bottlenecks. However, the right clearinghouse partner can fix the majority of the common issues that arise in association with 835s and 837s.

![[ANSWERED] What are 835 and 837 Files in Healthcare?](https://images.squarespace-cdn.com/content/v1/5aa96c579772aea9adaa2ef7/1693566145790-5FTAY1HO584PEJ1Y9PM0/whatis835837fileinhealthcare_23.png)